Biochar: what it is and why it matters

Part 1 of 2 on Biochar, an emerging CDR technology

You’re reading Terraform Now, a newsletter on the business of carbon removal. To support my work, you can subscribe or share this article with interested folks:

This is the first in a two part series on Biochar, a carbon dioxide removal (CDR) technology that gets some people excited, and others skeptical.

Today I’ll cover what Biochar is, and what makes it one of the most seductive technologies in carbon removal today. In Part 2, I share my concerns with Biochar and the pitfalls that Biochar providers will face as they try to scale.

What is Biochar?

Trees are 50% carbon by weight, and they get all this carbon by absorbing CO2 from the atmosphere. When trees die, they either decompose or burn. In both cases, carbon in the wood interacts with oxygen in the atmosphere to create CO2. For decomposition CO2 is released over many decades, while burning obviously releases CO2 much faster.

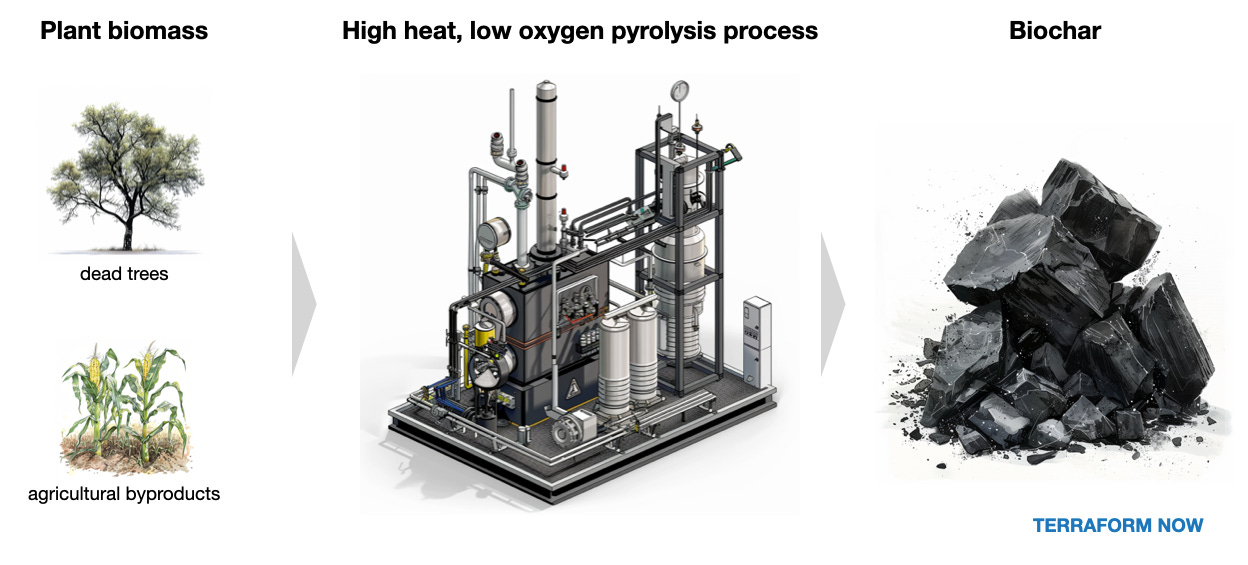

Here’s where Biochar comes in. Biochar is produced through a process called pyrolysis — we chop up the fallen tree and heat it up in a container with very little oxygen. Because there's not enough oxygen for the wood to burn1 completely, it doesn't release its carbon as CO2, and the carbon crystalizes into a stable form.

So instead of the dead tree becoming a source of emissions, we end up with a stable charcoal-like substance that won’t emit CO2 or other greenhouse gases for thousands of years.

To be clear, Biochar doesn’t require wood as an input — it can take just about any plant biomass. The most important up-and-coming input for pyrolysis is agricultural by-products like cornstalk and wheat straw. These are interesting because:

Ag byproducts decompose fast, releasing CO2 to the air in months. Trees typically decompose over decades

Ag byproducts are likely to be piled up and burned as waste, which would also release CO2

Just like trees, these byproducts that become Biochar won’t emit any CO2 or other greenhouse gases for thousands of years. You could just leave this Biochar in a pile and forget about it or bury it underground, but this stuff is actually useful for making soil healthier, so some farmers are willing to pay for it.

With that basic understanding, we can now get into what makes Biochar so exciting for buyers of carbon dioxide removal (CDR).

Biochar has a great business model

Relative to other CDR technologies, Biochar has an intriguing business model. Biochar delivers offsets quickly and cheaply, has multiple revenue streams, and requires less up-front capital than more industrial solutions like Direct Air Capture (DAC). It also is currently beating DAC on unit economics due to better physics / chemistry and has proven to be ‘verifiable enough’ for big buyers.

Let’s look at each of these in turn.

(1/5) Biochar delivers offsets quickly

If we look at two major BioChar players in the US, they have delivered on their promises to business customers:

Compare this to the delivery speed for DAC and Bio-oil, and Biochar looks excellent. This speaks to the technological maturity and chemical feasibility of Biochar. The technology here is simply a few decades ahead of Direct Air Capture. I’d still consider Biochar ‘subscale’ for the problems we are trying to solve, and we’ll get into why it might stay that way next week. But the tech is real and companies are having an impact today.

The short cycle times for Biochar are just wonderful. In a single agricultural season a small company can produce Biochar and deliver offsets. DAC facilities, by contrast, are taking years to build and running into all sorts of ‘first-of-its kind’ hurdles.

(2/5) Biochar is cheaper than Direct Air Capture

Now this process that involves ‘cooking biomass without oxygen’ sounds like it needs a lot of energy and heat, and it does. But relative to the alternative CDR methods Biochar is quite efficient. Lower energy and heat requirements explain why Biochar costs between $25 and $100 per ton of CO2, while DAC is upwards of $600 per ton.

And what makes Biochar so much cheaper? Biochar physics are just better than DAC.2

When people think about CDR and DAC, they often think about the difficulty of capturing CO2 from the air. But capturing CO2 is the easy part. The energy- and cost-intensive part of the process comes from stripping the CO2 away from whatever chemical you’ve used to capture it. This is typically 65-85% of energy requirements for a DAC chemical reaction.

Biochar gets around this problem because it doesn’t ever have to remove CO2 from another chemical. Instead of dealing with carbon dioxide from the atmosphere, Biochar is dealing with carbon in wood, corn stalks, or other plant matter. Instead of stripping away CO2, it just has to stabilize the carbon in a way that prevents it from becoming CO2.

(3/5) Biochar companies can sell the same product to two customers… sometimes

Microsoft recently announced that they’ll be purchasing almost 100,000 tons of Biochar credits from Next150, by far the largest Biochar deal yet. This deal proves that big CDR buyers are taking Biochar seriously, as other tech companies typically follow Microsoft’s lead.

But forward-thinking companies looking to buy offsets are not the only potential Biochar customers. Some farmers will pay Biochar companies for their physical charcoal-like product because it improves soil health.

So, two birds with one stone, right? If only it were that simple. While helpful, Biochar is not exactly a magical elixer for all soils. Biochar improves soil in 4 ways — (1) it helps soil hold water (2) it helps it hold nutrients, (3) it is an anti-toxin, absorbing things like plastics that might otherwise degrade the soil and (4) is an OK fertilizer, which means that farmers don’t have to rely as much on expensive man-made fertilizers.

Sadly, these have only a small impact on soil health, and many farmers see Biochar as just another product with big promises and mixed results. That’s why putting Biochar in soil is not standard practice in agriculture already.

Perhaps that will change. Biochar works best in fully organic farms, and this segment is growing. Smart Biochar companies can get leads relatively easily, as in most countries organic farms submit regulatory filings. These companies will need to develop a targeted, smooth sales motion for farmers, and from the outside looking in it seems no one has cracked this yet.

I’ve written before about how CDR companies are looking for more revenue streams via consumer buyers. In that article I was critical of two large Biochar players, Wakefield and Pacific, for ignoring the consumer market altogether.3 But given the constraints that these companies are dealing with — namely, small marketing and sales teams — it probably makes sense for them to focus on their core buyers of businesses and organic farmers.

(4/5) Biochar requires less up-front capital than DAC

For many CDR companies, they are building first-of-its-kind facilities — think about the massive DAC facilities that Climeworks, Oxy, and Heirloom have to build. These are $500M+ investments.

Pyrolysis (the process used to make Biochar) has two advantages:

It is very well understood, so will not run into first-of-its-kind complexities

Pyrolysis facilities have a much smaller footprint, like the size of a semi-truck or a bit larger

Put these two together, and you have relatively low barriers to entry. That means the Biochar industry will start out as a fragmented competitive landscape — many small, local players. Entrepreneurs need to know enough to buy the right pyrolysis machine, build relationships with farmers, and sell effectively to CDR buyers. But it’s doable at a small scale in a way that DAC or even reforestation are not.

(5/5) Biochar is ‘good enough’ for big verifiers

The relationship between carbon in plant matter and CO2 is very well understood. It takes about 1.1-1.5 tons of plant matter to mitigate 1 ton of CO2, which means verifiers can get weigh-in readings of either inputs or outputs to the pyrolysis. That is an easily verifiable solution.

I mentioned Microsoft earlier. It is one of the few credible verifiers — organizations that are big enough, and with enough at stake from a climate perspective that when they choose to endorse a CDR solution, it’s better than some independent auditor giving that solution a high score.

That said, we probably didn’t need this big purchase from Microsoft to prove that Biochar is the real deal. All the big credible verifiers — Microsoft, Frontier, and Amazon — have purchased Biochar in the last year.

It’s not all sunshine and unicorns for Biochar

So there are a lot of reasons to get excited about Biochar. At this point, you might be wondering why we even need other CDR solution, and in particular why we need costly solutions like DAC if Biochar is so wonderful and cheap.

But I think we should hedge our bets, because Biochar may not get big enough to matter. In the next article, I’ll go deep on some of the concerns I have with Biochar — including land-use, sources of biomass, and the logistics challenge of doing Biochar at scale.

I’m certain that Biochar will be around as a CDR tool for a long time. The question is really how big and useful Biochar can be given constraints on its growth.

It’s worth recalling a little high school chemistry. When something is on fire, it is “oxidizing.” So when there isn’t much oxygen in the mix, the plant biomass not burning in the traditional sense, it’s just heating up, which has a different effect on the chemicals in the plant biomass.

Or rather, DAC processes as they are today, with relatively high energy and materials cost. I remain open to the idea that a number of changes could bring DAC costs down — falling energy costs, material costs, or novel ways of handling chemical processes in DAC

I have also praised Climeworks for trying to sell Biochar to consumers