One Million Tons of Biochar

Deliveries are King in the fastest growing segment of the CDR market

You’re reading Terraform Now, a newsletter on the business of carbon removal. To support my work, you can subscribe or share this article with interested folks:

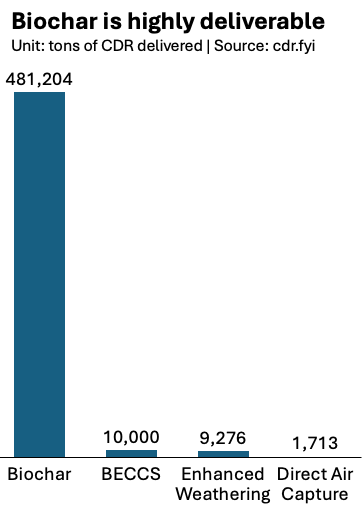

Biochar is fast approaching 500,000 tons of carbon dioxide removed, and as I write this in early 2025 the pace of deliveries is accelerating rapidly.1 In 2025, we’re likely to see Biochar reach a megaton of delivered CDR — 1 million tons. This will be a monumental achievement for Biochar and the CDR industry as a whole, and proves that a large number of entrepreneurs can make a difference in a relatively short period of time.

Take Exomad Green, the leading producer of CDR credits from Biochar. In October 2023, it had delivered 0 tons, and now Exomad has delivered over 120,000 tons, according to cdr.fyi.

Deliveries are hard to come by in CDR. Frontier, which buys CDR on behalf of companies, just reported that they missed 84% of their deliveries for 2024.2 Other players, across technologies, are surely falling short of the ambitious timelines they set for their projects. I’m sure that many Biochar projects face delays, and that some fail altogether. But it’s clear that, on average, Biochar is the most deliverable CDR in the short-term. That inspires tremendous confidence.

A few delivery trends are worth calling out:

Deliveries explain sales success: the companies with the highest deliveries have the highest sales, with deliveries explaining ~90% of the variance3 in sales outcomes4

Lots of producers: 12 companies have delivered >10,000 tons, and 31 companies have delivered >1,000 tons

Healthy geographic mix: While most deliveries have come from the Western Hemisphere, every major region is represented and has multiple producers that can scale up. Many future projects are focused on Africa and Asia, so we should expect this mix to change

Beyond deliverability

Two other positive developments in the Biochar market are driving sales and bringing new biochar producers into the market. First, recent studies have suggested that Biochar is more durable than previously expected. Consensus is that Biochar (done right) has >1000 year durability, whereas just a year ago there was more uncertainty. That makes Biochar a higher-quality purchase, and easier to justify.

Second, Biochar producers are finding real co-benefits with local communities. Google’s recent 100,000 ton deal with Varaha in India is a prime example:

Project developer Varaha will produce the biochar from an invasive species of mesquite that has aggressively advanced into India’s grasslands, sucking up soil nutrients and moisture and crowding out the native ecosystem. The damage has depressed milk production from cattle grazing, damaging local livelihoods. The problem has become so acute that local governments across the country fund eradication programs to remove the shrub. But there hasn’t been a clear plan for what to do with the huge brush piles once they’ve been pulled out of the ground.

Biomass sourcing is easier when you have to eliminate an invasive species, and CDR buyers love co-benefits. This is one creative approach to biomass sourcing, and we should expect to see many more. Co-benefits is not a passing trend - it’s a core selling proposition for CDR.

Watchouts for the Biochar industry

The question is what happens when producers run out of easy-to-source biomass with strong co-benefits. I’ve taken plenty of heat for my skepticism that Biochar will get anywhere close to the 2.6 billion tons that the IPCC predicts it can reach. There is simply not enough easy-to-source biomass, and Biochar is competing with other forms of carbon removal — namely Bio Energy with Carbon Capture and Storage (BECCS) and bio-oil — for biomass.

As both Biochar and BECCS ramps up, they will compete over dry woody biomass, and to what end? Will we see more problematic biomass sourcing like we have in BECCS, but on the Biochar side? It remains to be seen.

A more immediate trend that should worry the Biochar ecosystem is prices, which have been rising ~20% per year in real terms since 2020. There are two issues with rising prices:

Undercuts affordability: One reason Biochar is so attractive is because it was advertised as the only <$100 per ton CDR that was truly durable. Now customers are consistently paying >$200 per ton. This will discourage buyers who are used to afforestation at $10 - $30 per ton from transitioning into the durable CDR market.

Attracts many entrepreneurs: Buyers are beginning to complain that they get too many Biochar companies reaching out to them, each of whom have started up in the last year and don’t have a real sense for just how hard this business is. In general, more entrepreneurs is good. But slower increases in prices would not have attracted so many entrepeneurs to the same space, all at once, muddying the waters and creating potential quality issues down the line. It’s strange, but rapidly rising prices from 2020-2024 increases the likelihood of Biochar scandals in 2028.

On the other hand, high prices allow low-cost producers like Exomad to go from small to large. They can charge lower than market prices and still have enough margin leftover to invest in more reactors, retain their people, and grow.

Exciting times for Biochar. On to 10 million tons delivered!

Disclosure: My employer, Climeworks, sells Biochar as part of our Solutions portfolios. This article was compiled entirely from public information, and does not reflect the views of Climeworks.

If you want to learn more about Biochar, see my previous articles on (1) an overview of Biochar and why we should be excited about it (2) some of the challenges Biochar suppliers will face as the market scales up

Source: Frontier’s website. Click on Progress and hover your cursor over 2024. You’ll see that Frontier’s partners delivered 9,802 tons out of the 60,875 promised

My own calculations based on cdr.fyi data

2025 is off to a hot start for Biochar sales. On January 16th alone, Google purchased 100,000 tons each from Varaha (India) and Charm (yes, Charm is doing Biochar and Bio-oil now), and Shopify made smaller purchases from Applied Carbon (US), BIOSORRA (Kenya), MASH Makes (India), Planboo (Global)

Interesting article Joe, and things look positive for BCRs. You focused mainly on the carbon value here and also the feedstock issues, but didn't mention anything about the demand for biochar itself (as a product). The robustness of the credits needs it to be sequestered, and that means someone ploughing it into their soil. While quantities being produced are still relatively low, this can be absorbed and this provide robust sequestration route. But as things scale, will the demand be able to keep up to absorb the larger volumes? Or is this potentially a risk to BCR issuance?

https://nanonuclearenergy.com/about-us/

May be interesting to you.