The DAC business case is getting better

BlackRock's $550M investment shows that the DAC business model is more compelling than it was 12 months ago

You’re reading Terraform Now, my newsletter on the business of carbon removal. To support my work, you can subscribe here or share this article with interested folks

Yesterday BlackRock announced a $550M investment in a Direct Air Capture (DAC) plant being built by Occidental Petroleum. An investment of this size, and from such a reputable investor, sends a profound signal — that the business case behind DAC is compelling.

BlackRock, even more than most investors, is relentlessly focused on marginal unit economics. In plain English, this means two things:

Cost: How much does it cost to produce the next unit? How are these costs changing over time?

Revenue: What price can the next unit produced get on the open market? How are these prices changing over time? How defensible is this price?

Here’s the current state of DAC, with revenue per ton on the left and cost per ton on the right:

At first glance, the unit economics for DAC are uninspiring. Costs per ton are more than revenue, and costs are uncertain and highly variable. Yet this looks better than it looks a year ago — revenue per ton is way higher, and the promise of scale could bring down costs.

Revenue catalysts

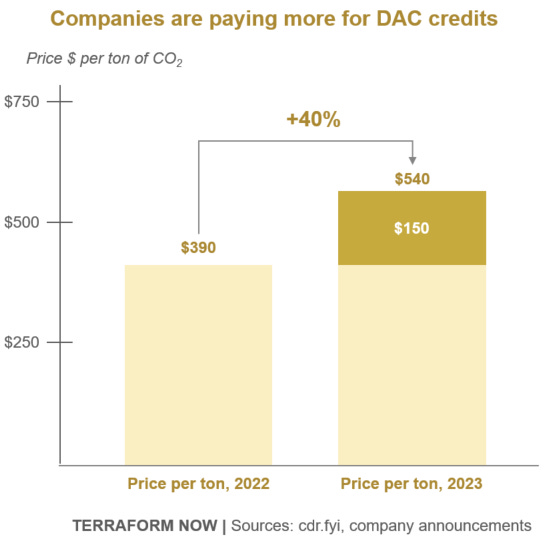

There are two catalysts on the revenue side. First, DAC credits are fetching much higher prices from private buyers, up ~40% since 20221:

Second, DAC gets much larger subsidies from the US government, up 3.6x since 2022:

Perhaps more important than the increase itself are the new rules that allow DAC producers to sell these credits. That makes it a much more valuable asset, since once it has been used to wipe out taxes for DAC providers, it can be sold to others (at a slight discount).

Put both the tax credit and the price increases together, and revenue per ton is up 63% in just a year!

While much has been made of America’s green subsidies, it’s the steady increase in DAC prices paid by private buyers that is a bigger draw for a long-term investor like BlackRock. Supply of these credits is highly restricted, which is driving up the price. Some companies are contracting for more than $1000 for DAC credits.

There are cheaper ways to offset your company’s carbon emissions, but after a bunch of scandals buyers are less interested in reforestation and other unverifiable schemes. As I wrote in CDR’s Best Quarter Yet:

Instead of going for many, cheap credits, buyers are choosing fewer, more expensive, and higher quality credits. Three indicators of quality — permanence, verification and transparency — now top the list for buyers

There are very few of these high quality credits to go around, and given the immense capital expenditure involved in building a DAC plant2 it’s unlikely that there will be a rush of new supply. So, prices will remain high and the big moat of building plants should make prices defensible for a while.

The ‘Early Adopter’ critique of high prices

One criticism of DAC is that it’s only for early adopters like Big Tech companies who like to lead the market in all things. And it’s true that the big orders have come from Microsoft and Amazon. But have a look at some of the customers for three big DAC providers — Oxy (via subsidiary 1PointFive), Climeworks, and Heirloom:

With the exception of Heirloom’s customers, this is not a list of Silicon Valley trendsetters. It’s a fairly diverse set of (Western) buyers dipping their toes into DAC credits. I’m not saying DAC is going mainstream — it’s far from that — but we should be encouraged by the broad range of industries represented among early customers.

Costs

No DAC player is transparent about cost per ton. One benchmark, using a small data set, has the weighted average cost at $718 per ton, implying that an efficient DAC project could breakeven at current average revenue per ton.

It is certainly possible that Oxy is on track to get lower costs down when Stratos is scaled up in 2-5 years, but it’s not off to a good start. The plant is 30% complete costs are higher than expected. From Reuters:

Occidental on Tuesday [Nov 8] increased project costs to $1.3 billion, the second price increase this year. The project was estimated between $800 million and $1 billion in 2022. Its start-up is planned for 2025, from 2024 previously.

Costs will remain a mystery in the short run, for Oxy and the whole industry. And even in the best scenario, costs will not decline fast. Unlike many climate tech cost-curves that we’re used to, like solar panels and batteries, DAC is not a manufacturing process. It’s a combination of chemical engineering and construction, neither of these benefit as much from scale as manufacturing.

But that does not mean there are no benefits to scale and leaerning — these benefits are just slower. It’s likely that DAC costs come down from $700 - $1,000 per ton to the $300 - $500 range in the 10-15 years. The literature suggests that lower costs that this are theoretically possible, especially for Oxy’s liquid-based DAC that it just picked up in the Carbon Engineering Aquisition.

Final thoughts: 550 million reasons to be excited

When I started writing about Direct Air Capture a few months ago, I did not expect to spend so much time thinking about Oxy, a fossil fuel company. To their credit, the folks at Oxy have been very active: acquiring Carbon Engineering, persuading customers like Amazon to sign on, winning grant money from the US government, and now onboarding BlackRock as an investor in Stratos.

When I first evaluated the Oxy & Carbon Engineering partnership, before the acquisition, I noted that Oxy could bring in more financing than Carbon Engineering ever could alone:

So I’m not surprised that Oxy brought in an outside investor. Having said that, BlackRock’s check size is simply mind-boggling. I spent three years doing due diligence for big investors like BlackRock and I can tell you that savvy investors do not write half-billion dollar check on reputation alone. The revenue plan must be solid, and there has to be high technical confidence in a path to lower costs.

That said, this investment does not vault Oxy to the top of my DAC Power Rankings. I believe there are only two signals of winning in the DAC market — scale & cost.

In spite of all the noise Oxy has been making, we don’t yet have a signal on either. BlackRock seems to be excited about cost, but I haven’t seen any data suggesting Carbon Engineering is cheaper than Climeworks or Heirloom. And big plant announcements are great, but these cost overruns and schedule delays are concerning.

The DAC provider that delivers >50,000 tons of carbon credits to customers first at will be at the top of my DAC Power Rankings. The top contenders are Climeworks, and Oxy, with Heirloom a not-too-distant third.

I prefer to use a Carbon Dioxide Removal (CDR) benchmark over reported DAC prices because (i) ultimately DAC will complete with other CDR methods on price and (ii) DAC sales are too low to create a reasonable price index and

Or other Carbon Dioxide Removal technologies